In May of 2025, Maureen Washington recieved a letter from the Ministry of Finance stating that she owed $110,076.91 in relation to the Speculation and Vacancy Tax (SVT). On Jan. 13, she received another letter confirming the debt had been fully cancelled following a successful appeal.

Washington described the eight months between those two moments as a fight for her home.

“I was relieved, but relieved in a way that’s hard to put into words,” Washington said of opening the letter. “It wasn’t like, ‘yay,’ because of what I went through.”

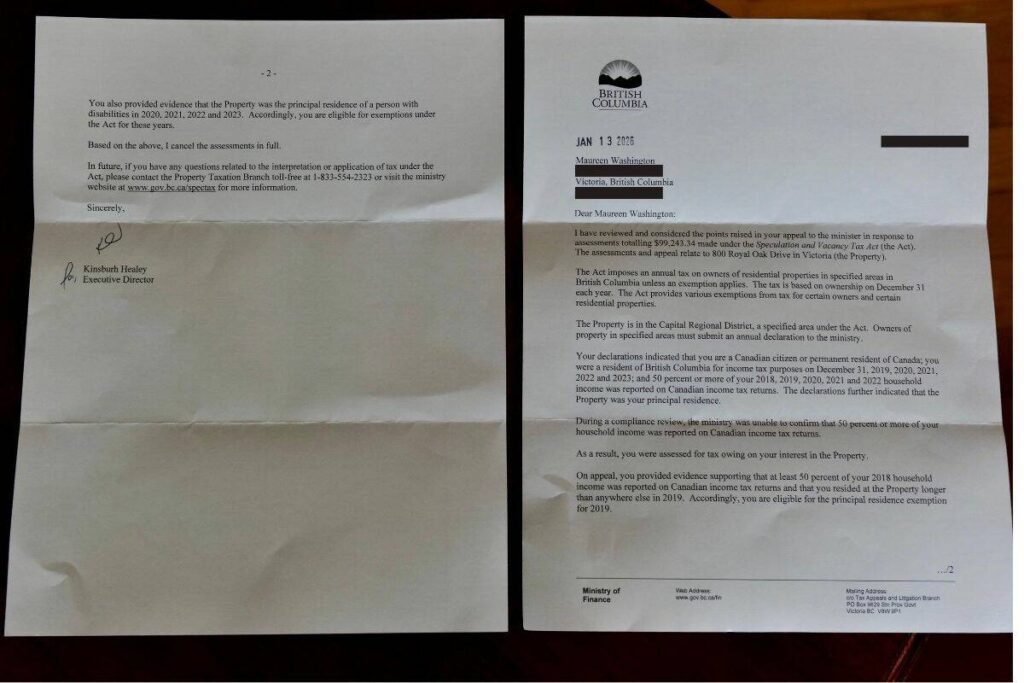

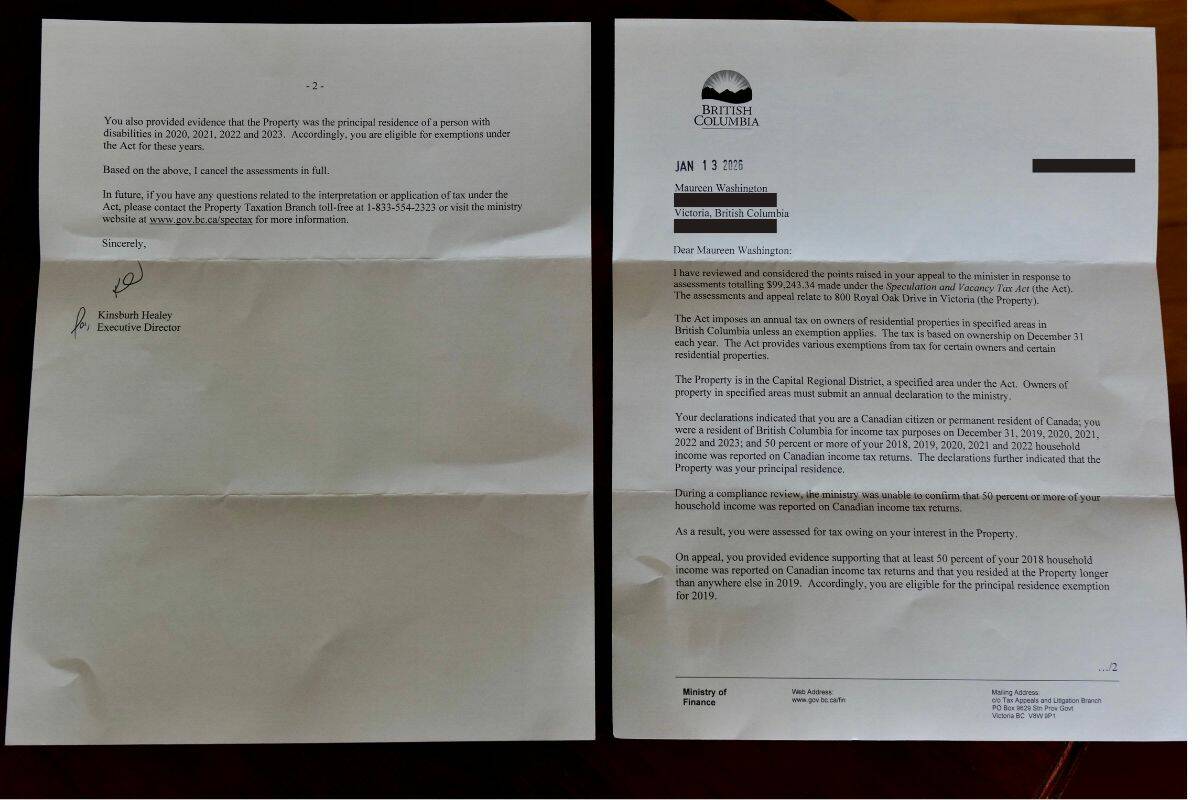

The letter, issued by the Ministry of Finance after a lengthy appeals process, confirmed Washington was exempt from the SVT for the years in question and that the outstanding balance would be reduced to zero.

The letter issued on Jan. 13 from the Ministry of Finance explained that all of the Speculation and Vacancy Tax assessments would be cancelled in full. (Tony Trozzo/Saanich News)

The decision brought an end to a case that had grown to six figures through automated reassessments, despite Washington having already had most of the disputed years removed during the appeal.

At its peak, the amount owing was north of $110,000.

“I would still get the bills,” she said. “You’re now at $107,000, and now you’re at $110,000. Even when I knew some of the years had been taken off, seeing those numbers was still overwhelming.”

By the time the appeal was nearing completion, Washington said only a single tax year (2018) remained under review.

Still, the uncertainty weighed heavily.

“There were moments where I really thought I was going to have to sell my house,” she said. “That’s my retirement. That’s my children’s inheritance. The idea that I could lose it over this was devastating.”

Speaking to Saanich News in May 2025, Washington said she had was shocked when she first got the notice – she said she had never rented out her home, and never left it empty.

For Washington, the problem didn’t stem from whether she lived in her home, but instead was due to how much income she reported.

In 2023, she recieved a notice after not filingher taxes for several years, triggering a provincial audit.

“They said because I reported a low income and live in an expensive neighbourhood, they needed to prove I wasn’t living beyond my means,” she explained.

Washington said she was required to provide extensive documentation during the appeal, including years of financial records, bank statements and proof of household arrangements.

According to the ministry, property owners who believe the SVT was applied incorrectly can appeal their assessment within 90 days of the date listed on the notice.

Once an appeal is filed and meets legislative requirements, it receives a full review to determine whether the tax legislation was applied correctly based on the specific facts of the case.

From there, an appeals staff member contacts the property owner during the review to discuss the file, explain the assessment or decision being appealed, request additional information if needed, and respond to questions.

Following that process, a ministry’s representative makes a final decision and notifies the property owner in writing.

“In general, if a change is made to an assessment through the appeal process there will have been new or additional information provided during the appeal review which impacts the application of the legislation to the property owner,” said the ministry.

Washington said the process left her feeling conflicted once the outcome was known.

“You go, ‘yay,’ because four years were gone,” she said. “And then you go, ‘what?’ Why wasn’t that known at the start? Why did I have to go through all of this for that to come out in the end?”

The appeal decision brought final clarity on Jan. 13 when Washington received written confirmation that the remaining balance had been cancelled.

“It was a sigh of relief,” she said. “But it wasn’t excitement.”

Washington emphasized that her experience did not change the factual basis of the tax itself, but rather highlighted how the appeal process unfolded in her case.

“I always knew I lived in my home,” she said. “That was never in question for me.”

“There were points where I felt stripped of everything,” she said. “Like I had no rights except to keep proving myself over and over again.”

Despite the stress, Washington said she continued to pursue the appeal because she believed the bill was incorrect and hoped the issue would be resolved.

“I knew I hadn’t done anything wrong,” she said. “I just didn’t know how long it would take for that to be recognized.”

The Jan. 13 letter marked the end of the appeal process and formally cleared the debt.

“When I finally saw it in writing, that was when I could believe it,” Washington said. “Until then, you just keep waiting for the other shoe to drop.”

She said the experience has stayed with her, even after the outcome.

“It’s bittersweet,” she said. “I’m grateful it’s over. But it’s hard not to think about what those months were like, and how close it felt at times.”

Washington said she hopes others facing similar letters will pursue clarification and appeal if they believe a mistake has been made.

“When you’re in it, you look for any sign that someone else made it through,” she said. “I didn’t see many of those stories.”

For her, the process ended with the cancellation of the full amount and confirmation that she no longer owes any money to the province.

“That part is done now,” she said. “And that’s what matters.”

READ MORE: ‘I live here’: Saanich woman stunned by $110K speculation tax bill